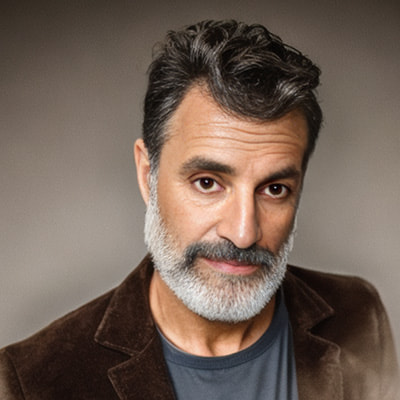

Mike is our Senior Editor and experienced gambling strategist. A former hockey player, he transitioned to the casino industry after finishing his B.A. in English. Blackjack systems, online casino guides, gambling terms, and more - Mike is familiar with all fine points of gambling.

US Gambling Legislation by State– Online Casino Laws in 2025

Gambling legislation in the US varies by state, so it can be challenging to track all the changes across the nation. While some states have existing online casino laws, others are yet to legalize online gambling in any capacity. Learn more about each state's laws, potential future legislation, and tax details.

Overview of US Online Gambling Laws

When examining US online gambling laws, players must know the differences between federal and state legislation. On a federal level, gambling is not illegal, and most forms of gambling are allowed. However, each state has the power to form its own legislation so they can ban or allow any type of gambling.

As an example from our research, most forms of gambling are legal in Indiana, while South Carolina only has lotteries. Currently, only six states allow online casinos: Pennsylvania, New Jersey, Michigan, West Virginia, Connecticut and Delaware. Rhode Island will launch online casinos in 2024, so we hope more states will follow.

Sports betting is legal in many states, with many more allowing or tolerating fantasy sports. Wagering on sports was initially outlawed due to the Professional and Amateur Sports Protection Act, which prohibited gambling activities on all sports events. After being ruled unconstitutional in 2018, the law was repealed, and many states began legalizing sports betting.

Meanwhile, online casinos are more tightly controlled with various laws. The Federal Wire Act prohibits using electronic communication for gambling, although it is debated whether it affects online casinos. Meanwhile, the Unlawful Internet Gambling Enforcement Act prohibits online gambling in states where it is not legalized.

Tribal casinos, which are protected by the Indian Gaming Regulatory Act, tend to be excluded from such US gambling legislation. Native American tribes can establish casinos and apply for licenses, which allow them to operate different games. Lotteries and charity bingo games are also legal in most states.

Map to All States with Legal Online Casinos

The rest of the editorial team agrees that keeping up with online gambling regulations can be difficult. As each state is responsible for its legislation, the legal forms of gambling can vary. That is why using a table or a map can be helpful. It allows you to check and compare the different states quickly.

With the repeal of PASPA, many states have begun revising their legislation, so we expect online gambling laws to be updated further in the future. We are always looking for any such changes and will update the guide when new laws appear. Remember to check your state's regulations carefully.

Online Gambling Laws in Pennsylvania

As of the time of writing, Pennsylvania allows all forms of gambling within its territory. The state's gambling legislation originally allowed only state lotteries, thanks to Act 91 from 1971. However, after many attempts, all forms of gambling were legalized with the Pennsylvania Racehorse Development Act of 2004.

Aside from legalizing racetracks and casinos, the act also established the Pennsylvania Gaming Control Board. That is the state's main licensing authority, ensuring all operators comply with the laws. Initially, it licensed seven racetrack casinos, five standalone ones, and two resort casinos. Since then, the industry has achieved success and continues to be profitable today.[1].

| Pennsylvania Online Casinos | Sign Up Bonus | Bonus Code | All Casino Games | Min. Deposit | Licensed by | Legal In | Site Rating | Secure Link | Terms |

|---|---|---|---|---|---|---|---|---|---|

| BetMGM | 100% up to $1,000 + $25 On the House | Not Needed | 902 Casino Games | $10 | Pennsylvania Gaming Control Board | MI, NJ, PA, WV | PLAY NOW! | Valid only for new PA players over 21 years of age. Opt-in required. Min. deposit $10. Full T&C's apply. | |

| BetRivers | Up to $250 First Deposit Bonus | PACASINO250 | 682 Casino Games | $10 | Pennsylvania Gaming Control Board | MI, PA | PLAY NOW! | New players only. Bonus paid as site credit expiring in 30 days. PACASINO250: Bonus match of first deposit (up to $250). 1X playthrough requirement on select games. Full T&Cs apply. | |

| Spin Palace Casino | 100% Deposit Match up to $1,000 | Not Needed | 122 Casino Games | $10 | Pennsylvania Gaming Control Board | PA | PLAY NOW! | Valid only for new PA players over 21 years of age. Full T&Cs apply. |

Following this initial success, the state would pass another bill in 2017, which allowed the creation of mini-casinos. Compared to larger standalone ones, they can only have up to 40 table games but can have up to 750 slots. However, this new legislation also legalized Pennsylvania online casinos.

Players could now access their favorite games from the comfort of their homes. While eSports betting is prohibited, players can bet at online sportsbooks and daily fantasy sites. The Pennsylvania Lottery has also begun offering online draw games. Finally, bingo games can also be organized, and taverns can host raffles.

Taxes on PA Online Gambling Winnings

As of the time of writing, Pennsylvania gambling legislation considers all gambling prizes, except non-cash prizes from the state lottery, as taxable income. Aside from the 24% federal tax on winnings of $5,000 or more, they are also subject to a 3.07% personal income tax. The state also has three different categories of prizes: cash, non-cash and mixed.

- Federal tax: 24%

- Personal income tax: 3.07%

Along with their prize, winners will also receive form W-2G to report their winnings for the federal tax. Meanwhile, individuals have to use P-40 Schedule T to report their personal income tax. Pennsylvania residents are also taxed on all sources of winnings, which includes Powerball and Mega Millions tickets bought in other states.

Pennsylvania has a decent gambling tax rate compared to other US states. Additionally, the PA Department of Revenue's guide on reporting gambling and lottery winnings provides further details on the process.

Legal Play Requirements in Pennslyvania

To play any gambling games in Pennsylvania, you should be familiar with the legal gambling age. For horse racing, bingo, and lottery games, you must be 18 years old, while for casino games, you must be 21. Additionally, as required by US online gambling laws, legitimate online casinos will ask for proof of income to verify your identity.

However, the state also allows non-residents to participate in state gambling games, as long as they are within the state's territory. Any winnings derived from such games must be reported to the government as Pennsylvania income tax. That is why reading the laws carefully is a good idea, even if you are not a state resident.

New Jersey Online Gambling Legislation

New Jersey is decently permissive when it comes to gambling and has been at the forefront of many changes to online gambling regulation. The first land-based casino in NJ opened in 1978, with the NJDGE being established a year earlier. However, casinos could only be established within Atlantic City, making it a prominent gambling destination.

New Jersey also attempted to implement sports betting in 2012 but faced a lawsuit from various organizations, such as the NFL and NBA. While the court ruled in favor of the organizations, New Jersey would challenge PASPA in 2014. That would lead to PASPA's repeal and the implementation of online sports betting. Currently, there are 23 licensed online sportsbooks in the state.

| NJ Online Casinos | Sign Up Bonus | Bonus Code | All Casino Games | Min. Deposit | Licensed by | Legal In | Site Rating | Secure Link | Terms |

|---|---|---|---|---|---|---|---|---|---|

| Golden Nugget | Deposit $5 Get $50 in Casino Credits | Not Needed | 1.555 Casino Games | $10 | New Jersey Division of Gaming Enforcement | MI, NJ | PLAY NOW! | Valid only for new NJ players over 21 years of age. Bonus offer must be claimed with the first single deposit. Free Spins can only be applied to eligible games. Full T&Cs apply. | |

| BetOcean Casino | Up to $1,500 + 50 Free Spins | Not Needed | 1.287 Casino Games | $10 | New Jersey Division of Gaming Enforcement | NJ | PLAY NOW! | Valid only for new NJ players over 21 years of age. Full T&Cs apply. | |

| BetMGM | 100% up to $1,000 + $25 On the House | Not Needed | 1.538 Casino Games | $10 | New Jersey Division of Gaming Enforcement | MI, NJ, PA, WV | PLAY NOW! | Valid only for new NJ players over 21 years of age. Opt-in required. Min. deposit $10. Full T&C's apply. |

As of 2013, players can also participate in New Jersey online casinos. According to the online gambling laws, operators must partner with land-based casinos in Atlantic City to receive a license and host their servers. New Jersey is also one of the first states to form an interstate online poker network with Nevada and Delaware.

Finally, players can participate in horse racing, bingo, and lottery. The New Jersey Division of Gaming Enforcement licenses all legitimate operators. Aside from overseeing the online casinos, the NJDGE also ensures players practice responsible gambling by introducing various tools.[2]

Taxes on Winnings from Online Gambling in NJ

As with other states, US gambling legislation requires players to file form W-2G when receiving winnings over $5,000 or over $600 and 300x the wager. Aside from that, all gambling winnings in New Jersey are taxed at 3% for residents and non-residents. Players can also use their losses to offset the reported winnings according to the NJ Treasury's guide on gambling taxation.

- Federal tax: 24%

- Gambling income tax: 3%

- Lottery tax for winnings between $10,001 and $500,000: 5%

- Lottery tax for winnings over $500,000: 8%

- Lottery tax for winnings over $10,000 without providing a valid Taxpayer Identification Number: 8%

While lottery winnings over $10,000 are taxed, only the total individual amount is considered and not the overall winnings during the year. Additionally, if you split the winnings with someone, they will have to pay the same rate as the total amount.

Lastly, New Jersey residents must report all gambling winnings, even those won outside the state. If a player's losses exceed the winnings, that must be reported as zero income. Always make sure you are familiar with the laws before participating in online casino games.

New Jersey Requirements for Legal Play

New Jersey gambling legislation is similar to that of other states, where the legal gambling age depends on the type of game. Lottery and daily fantasy games allow 18-year-old players to participate, but you must be 21 to play at casinos. You may also need to provide proof of income and other documentation when signing up for online casinos.

However, the state does allow non-residents to participate in NJ gambling games. They must be physically present in the state and report any winnings from New Jersey operators. When signing up for online casinos, you should also ensure you provide valid information to avoid issues when claiming winnings.

Michigan Online Gambling Laws

Michigan is another state with a long history of gambling legislation. Horse racing was legalized in 1933, but it would take until 1972 for lotteries to become legal. Michigan would also be one of the first states to join "The Big Game", which would eventually become known as Mega Millions.

What sets it apart is the many tribal casinos, currently numbering 11 statewide. These were legalized through various compacts, with the first signed in 1993 by the Saginaw Chippewa tribe. In 1997, the Michigan Gaming Control and Revenue Act was signed into law, creating three commercial casinos in Detroit: MGM, Motor City, and Greek Town.

| Michigan Online Casinos | Sign Up Bonus | Bonus Code | All Casino Games | Min. Deposit | Licensed by | Legal In | Site Rating | Secure Link | Terms |

|---|---|---|---|---|---|---|---|---|---|

| Caesars | Up to $1,000 Deposit Match | IGCA2500 | 256 Casino Games | $10 | Michigan Gaming Control Board | NJ, PA, WV | PLAY NOW! | Must be 21+ and physically present in MA, PA, NJ and WV only. New users and first deposit. Wager $25+ to receive 2,500 Reward Credits. Full T&Cs and wagering requirements apply. | |

| BetRivers | Up to $500 in Casino Losses Back | CASINOBACK | 1.740 Casino Games | $10 | Michigan Gaming Control Board | NJ | PLAY NOW! | New players only. Min. $10 deposit to quality, CASINOBACK: Bonus money match of casino net losses in first 24 hours of play up to max. designated amount. 1X playthrough requirement on select games. Bonus money expires 30 days from Issuance it playthrough requirement unmet. Full T&Cs apply. | |

| PokerStars | 100% up to $600 | STARS600 | 722 Casino Games | $10 | Michigan Gaming Control Board | NJ, PA | PLAY NOW! | Valid only for new MI players over 21 years of age. Opt-in required. Full T&Cs apply. |

This act also created the Michigan Gaming Control Board, which governs all gambling activities in the state. That includes licensing Michigan online casinos as of 2019, when Gov. Gretchen Whitmer signed the Internet Gaming Bill.[3] Both tribal and commercial casinos could now operate online casino sites.

Additionally, this law also legalized land-based and online sports betting, as well as daily fantasy sites. This law expanded the options available to players in the state, as it also allowed online horse racing, bingo, and poker. When coupled with the tribal casinos, this state features plenty of gambling opportunities.

Taxes on MI Online Gambling Winnings

Michigan applies a 4.25% personal income rate on gambling winnings. Unlike other states, this applies to all gambling products and has no minimum threshold. That means you must report all your winnings, regardless of their size. While it was not allowed to subtract losses before 2020, since 2021, players can do so if they itemized deductions on their federal returns.

- Federal tax: 24%

- Gambling income tax: 4.25%

Similar to online gambling regulation in other states, non-residents can participate but must also report any winnings obtained in Michigan. The first $300 won from gambling can also be excluded from the total household resources. The Michigan Department of Treasury's guide on reporting gambling winnings states you must use U.S Form 1040 Schedule A when deducting losses.

Legal Play Requirements in Michigan

Like with most US online gambling laws, players must be 21 years old to play at online casinos and participate in sports betting. However, 18-year-olds can buy tickets for the Michigan Lottery and play at daily fantasy sites. Remember to gamble responsibly and contact customer support if you need help.

It is worth noting that some tribal casinos allow players up to 18 years of age. Tribal casinos operate under the Indian Gaming Regulatory Act and can set their own legal ages. As such, if you plan on playing at these casinos, you should check their rules carefully.

West Virginia Online Gambling Legislation

West Virginia is another state that has aimed to expand the legal gambling options. It began in 1931 when pari-mutuel wagering was legalized, allowing players to bet on horse and greyhound races. Subsequently, the state lottery was legalized in 1984 after citizens voted in approval.

That led to the creation of the West Virginia Lottery Commission, which initially governed only the lottery. However, it has since expanded to become the state's main gambling authority and even licenses online casinos and suppliers.[4] In 1994, the state made video lotteries legal at four racetracks.

| WV Online Casinos | Sign Up Bonus | Bonus Code | All Casino Games | Min. Deposit | Licensed by | Legal In | Site Rating | Secure Link | Terms |

|---|---|---|---|---|---|---|---|---|---|

| DraftKings | Play $5, get $50 In Casino Credits | Not Needed | 2.424 Casino Games | $5 | West Virginia Lottery Commission | MI, PA, WV | PLAY NOW! | Valid for new customers. Must choose 1 offer and opt-in within 7 days (168 hours) of registering a new account. Must deposit min. $5 within 7 days (168 hours) of opting in to earn (a) a 100% deposit match up to $2,000 in Casino Bonus Funds or (b) a 100% deposit match up to $100 Casino Credits. Full T&Cs apply. | |

| BetMGM | 100% up to $2,500 + $50 & 50 Spins On the House | Not Needed | 844 Casino Games | $10 | West Virginia Lottery Commission | MI, NJ, PA, WV | PLAY NOW! | Valid only for new WV players over 21 years of age. Opt-in required. Min. deposit $10. Full T&Cs apply. | |

| BetRivers | Up to $500 in Casino Losses Back | CASINOBACK | 642 Casino Games | $10 | West Virginia Lottery Commission | NJ, PA, WV | PLAY NOW! | New players only. Min. $10 deposit to quality, CASINOBACK: Bonus money match of casino net losses in first 24 hours of play up to max. designated amount. 1X playthrough requirement on select games. Bonus money expires 30 days from Issuance it playthrough requirement unmet. Full T&Cs apply. |

However, it took until 2009 for table games to become legal and for the first land-based casino, the Casino Club at the Greenbrier, to appear. West Virginia was also among the first to introduce sports betting, passing House Bill 2751 even before PASPA was officially repealed. Meanwhile, daily fantasy games were legalized earlier in 2016.

Subsequently, in 2019, House Bill 2934 legalized online casinos and poker rooms, giving players even more options. As this market is still new, many companies are still aiming to get licensed by the West Virginia Lottery Commission. We hope more operators will appear in the future.

Taxes on WV Online Gambling Winnings

As of the time of writing, West Virginia does not impose a personal income tax on gambling winnings. Unlike online gambling regulation in other states, players only have to report the federal tax with the provided W-2G forms. Slot or bingo winnings must exceed $1,200, keno – $1,500, poker tournaments - $5,000 for them to be taxable. That also applies if you won over $600 with a 300x wager.

However, there have been attempts to introduce a personal income tax, such as the House Bill 4757. As such, keeping track of the laws for any changes is important. Remember that US gambling legislation is always subject to change.

West Virginia Requirements for Legal Play

West Virginia's legal gambling age varies depending on the game type. For the lottery, bingo, and pari-mutuel betting, you must be 18 years old. Meanwhile, casino games, sports betting, and daily fantasy sites require you to be at least 21 years old.

Additionally, players can only buy lottery tickets from physical retailers, as online lottery is still not available in the state. Residents and visitors can both participate in the games, although visitors have to be physically located within it. Note that you must prove you are of age before playing at online or land-based casinos.

Online Gambling Laws in Connecticut

Connecticut is another state that has slowly been expanding its gambling legislation. Originally, in 1939, the only legal form of gambling was charity bingo games organized by non-profit organizations. However, the options expanded in 1955 with carnival games, raffles, and pull-tabs, which were legalized in 1972. Charitable gambling proved successful and opened the way for further legislation.

In 1971, pari-mutuel wagering and lottery were legalized with the same bill. Aside from horse and greyhound racing, players could also bet on jai alai at off-track betting sites. Meanwhile, the lottery began selling scratchcards and tickets to interstate lotteries, such as Powerball and Mega Millions.

Connecticut also has two tribal casinos: Foxwoods Resort Casino and Mohegan Sun. Foxwoods was the first casino that opened in 1986, and it began as a bingo parlor, later adding slots and table games. Meanwhile, the Mohegan Sun was opened in 1996, as the tribe had not received federal recognition until 1992. A third tribal casino owned by both tribes is also planned.

Despite the progress, players would not be able to play at Connecticut online casinos until 2021. After agreeing to provide exclusive online casino rights to the tribal casinos, Ned Lamont signed House Bill 6451. This bill legalized retail and online sports betting, online casinos, online lottery, and even daily fantasy sites.

As of the time of writing, Connecticut has no online operators. This is because the Connecticut Department of Consumer Protection has not yet issued licenses. We hope online gambling options will become available in the future.

Taxes on Winnings in Connecticut

Aside from the federal tax, residents have to pay a state income tax on all lottery winnings exceeding $5,000 or over $600 and 300x the wager. Winnings from other games are also subject to this tax, but only after passing the income test. For example, a single person winning over $1,200 must report his winnings.

- Federal tax: 24%

- State income tax: 6.99%

Visitors will also have to pay taxes if they pass the income test, but only for the winnings obtained within the state. According to the Connecticut Department of Revenue Services' gambling tax laws you cannot deduct losses for the state income tax. That is why you should always keep a record of your winnings.

Legal Play Requirements in Connecticut

The legal age is similar to the online gambling regulation in other states. To play at any of the tribal casinos or participate in online games, you will need to be 21 years old. Meanwhile, keno, lottery, and daily fantasy games are available to 18-year-old players.

Legitimate sites and operators will require verification, such as proving your age, before allowing you to play. Visitors can also participate in gambling within the state, but must be physically present and report any prizes acquired within Connecticut. Remember to gamble responsibly and contact customer support if you encounter any issues or need help.

Delaware Online Gambling Legislation

True to its nickname as The First State, Delaware plays a vital role in US gambling legislation. Horse racing has been legal in the state since 1933, with the first racetrack, Delaware Park, opening in 1937. Soon, two more racetracks would be opened: Harrington Raceway and Dover Downs, which would also become racinos.

Meanwhile, the Delaware Lottery was established in 1974, offering lottery tickets to Mega Millions and Powerball draws, alongside keno and video lottery games. However, it would also begin offering sports betting services starting from 2009. Even before PASPA was repealed, Delaware became an exception alongside Nevada, Oregon, and Montana.

However, it was initially only limited to NFL parlay bets. Following the repeal of PASPA, the state immediately expanded sports betting to other markets, such as basketball and hockey games. Sports betting is currently only available through retail operators, such as the three racinos. Online lottery tickets are also unavailable.

In 2012, Delaware also became the first state to legalize online casinos. The legalization of Delaware online casinos was thanks to the Delaware Gaming Competitiveness Act, which was signed into law by Governor Jack Markell. Currently, there are three sites partnered with each racino, although the operator has changed in recent years.[5] Delaware has also partnered with New Jersey and Nevada to form an online poker network.

Taxes on Winnings in Delaware

Delaware has a state income tax on all gambling winnings, regardless of the size or the game. However, unlike other US gambling legislation, the rate varies from 2.2% to 6.6% based on earnings. Additionally, losses can be deducted from the winnings, so you only have to report your net winnings.

- Federal tax: 24%

- State income tax: 2.2% - 6.6%

As with other states, non-residents can still play the games but must report any winnings obtained within Delaware. Always ensure you track your winnings and losses and provide accurate information on your tax forms. The Delaware lottery will also withhold 24% of winnings above $5000 for federal taxes.

Delaware Requirements for Legal Play

Before you can gamble in Delaware, you must meet the legal gambling age. For lottery tickets and horse racing, you must be 18 years old. However, to participate in any casino games or place sports bets, you must be 21 years old. You will also need to verify your age by providing the relevant documentation.

Visitors can also play at online casinos, although they must also report their winnings as state income tax. You may also need to provide proof of income to confirm there is no fraud. When signing up for an online casino, you should also check the available payment methods and read the banking policies.

Rhode Island Online Gambling Legislation

As of the time of writing, gambling legislation in Rhode Island is undergoing a significant change. Initially, players could only bet on horse and greyhound races, which were legalized in 1934. It would take until 1973 for lottery games to become legal and the establishment of the Rhode Island Lottery. It would soon become one of the founding states of the Multi-State Lottery Foundation, which helps its members operate interstate games such as Powerball.

Since 2020, the Rhode Island Lottery has also provided online gambling games in the form of keno and eInstants. However, players must still go to physical retailers to buy lottery tickets. After the repeal of PASPA, the Ocean State also began operating sports betting services. Players can bet at land-based casinos or online.

Currently, Rhode Island also has two land-based casinos: Twin River Casino Hotel and Tiverton Casino Hotel. Twin River was originally a racetrack, but was transformed into a Bally Corporation owned casino in 2003. It features more than 100 table games and 4,000 gaming machines, so players have decent options.

For a long time, Rhode Island did not have online casinos. On June 22, 2023, Governor Dan McKee signed Senate Bill 948, legalizing online casinos.[6] It is expected that online casinos in Rhode Island will begin operating in April 2024, with the provision allowing for mobile apps. As the Rhode Island Division of Lottery will be the governing authority, the state is preparing to implement these new gambling options.

Taxes on RI Online Gambling Winnings

As of the time of writing, the online gambling laws in Rhode Island impose a state income tax on all gambling winnings. Unlike other states, the tax rate is based on the player's annual income. That is why you should check your records carefully to ensure you fill in the correct information.

- Federal tax: 24%

- State income tax if annual income is up to $65,250: 3.75%

- State income tax if annual income is between $65,250 and $148,350: 4.7%

- State income tax if annual income is over $148,350: 5.99%

Visitors can participate in online gambling but must still file the state income tax for any winnings obtained in the state. Rhode Island also does not allow players to deduct losses from their winnings on tax forms. Remember that you must also file the W-2G form for federal taxes.

Legal Play Requirements in Rhode Island

As of the time of writing, players aged 18 can play any of the available gambling options. However, the new bill plans to change it to 21 years old for sports betting. That is why you should keep track of the law to see if there are any changes.

Aside from that, you must remember to provide valid identification to participate in any gambling activities. That could also involve providing proof of income to avoid fraud. Additionally, you should read any online operator's terms carefully before creating an account.

Other States Expected to Legalize Online Casinos

As of the time of writing, Rhode Island is the only state set to introduce online casinos. However, a few other states plan on introducing online casino bills. For example, Maine is currently discussing bill LD 1777, which could allow tribal casinos to operate online sites.[7]. Meanwhile, the Old Line State is preparing for its Senator Ron Watson to propose another bill for online casinos in Maryland.

- New York

- Maine

- Maryland

New York is another state with similar plans, as Senator Joseph Addabbo Jr. and Assemblyman Gary Pretlow continue to push for online casinos. However, states like Indiana and New Hampshire could not pass bills approving online casinos in 2023. Nevertheless, it appears more states will be attempting to legalize online casinos in the future.

Responsible Gambling

US online gambling laws require all operators to provide responsible gambling tools to help prevent addiction. That usually involves deposit limits, self-exclusion tools, and time limits. While some tools can be accessed from your account page, self-exclusion requires contacting customer support. Each site also has responsible gambling pages with more details.

If you require professional help, you can also contact various organizations with 24/7 hotlines and other resources. Each state has its own, such as the Council on Compulsive Gambling of New Jersey, so you should always check carefully. However, you can also contact Gamblers Anonymous and the NCPG from any state.

Frequently Asked Questions

Before concluding the guide to US gambling legislation, we will answer all your pressing questions. You can learn more details on the current laws, such as which states allow online casinos and how to pay taxes on winnings. We will also provide details on the states with online gambling legislation.

What are the states with present online gambling legislation?

Are the online gambling laws the same in all states?

What states have their own online casino laws?

Are winnings at online casinos taxable in the US?

Is it legal to play at online casinos outside of the states with regulated gambling?

Conclusion – Up to Date Information on US Gambling Legislations

I've been reviewing casinos for years and believe the future of US online gaming will be interesting. With the repeal of PASPA, many states have begun revising their online gambling laws, including provisions for online casinos. States such as Maine and New York have even already drafted proposals for future bills.

Mike is one of our most senior team members and contributes with over 20 years of experience in the gambling industry. He's our online and land-based casino review expert and a blackjack enthusiast. Mike's a table games strategist and is dedicated to helping you make informed decisions.

More about MikeThe success of Rhode Island online casinos will be another important factor. Depending on how they develop, other states may consider adopting their own online gambling legislation. While it is unclear what the future will be, I hope more states will open online casinos for their players. As such, you should always keep track of your state's legislation for updates.

References

- (September 20, 2023), Gambling Insider, Pennsylvania's gaming industry sees August boost in iGaming, Retrieved on January 12, 2024

- Fletcher, Robert, (June 23, 2023), (iGaming Business North America), NJ Launches New Responsible Gambling Tools, Retrieved on January 12, 2024

- (March 11, 2019), Gaming Intelligence, Michigan Lawmakers Reintroduce iGaming and Fantasy Sports Bills, Retrieved on January 12, 2024

- Fletcher, Rober, (August 22, 2022), (iGaming Business Affiliate), Leadstar Media Lands iGaming Affiliate Licence in West Virginia, Retrieved on January 12, 2024

- (January 4, 2024), AffPapa, RSI Launches Online Wagering for Delaware Lottery, Retrieved on January 12, 2024

- Thomas-Akoo, Zak, (June 22, 2023), (iGaming Business), Rhode Island Becomes Seventh State to Legalize iGaming, Retrieved on January 12, 2024

- Horner, Charlie, (January 4, 2024), (SBC Americas), Maine to Reconsider Tribal Online Casino Bill in 2024, Retrieved on January 12, 2024